Optimize Mobile Payment Apps to Boost Conversion Rates

March 22, 2023

Mobile payments are gaining popularity among customers worldwide, with the global market size recorded at $53.5 billion in 2022. It is projected that the mobile payment market will reach around $607.9 billion by 2030, according to Facts & Factors. Despite the immense growth potential of this industry, businesses need to optimize their mobile payment platforms for a seamless user experience to increase their conversion rate.

So, what are the common types of mobile payment methods? How can businesses improve the mobile payment experience on their platform? Let’s figure it out through this blog!

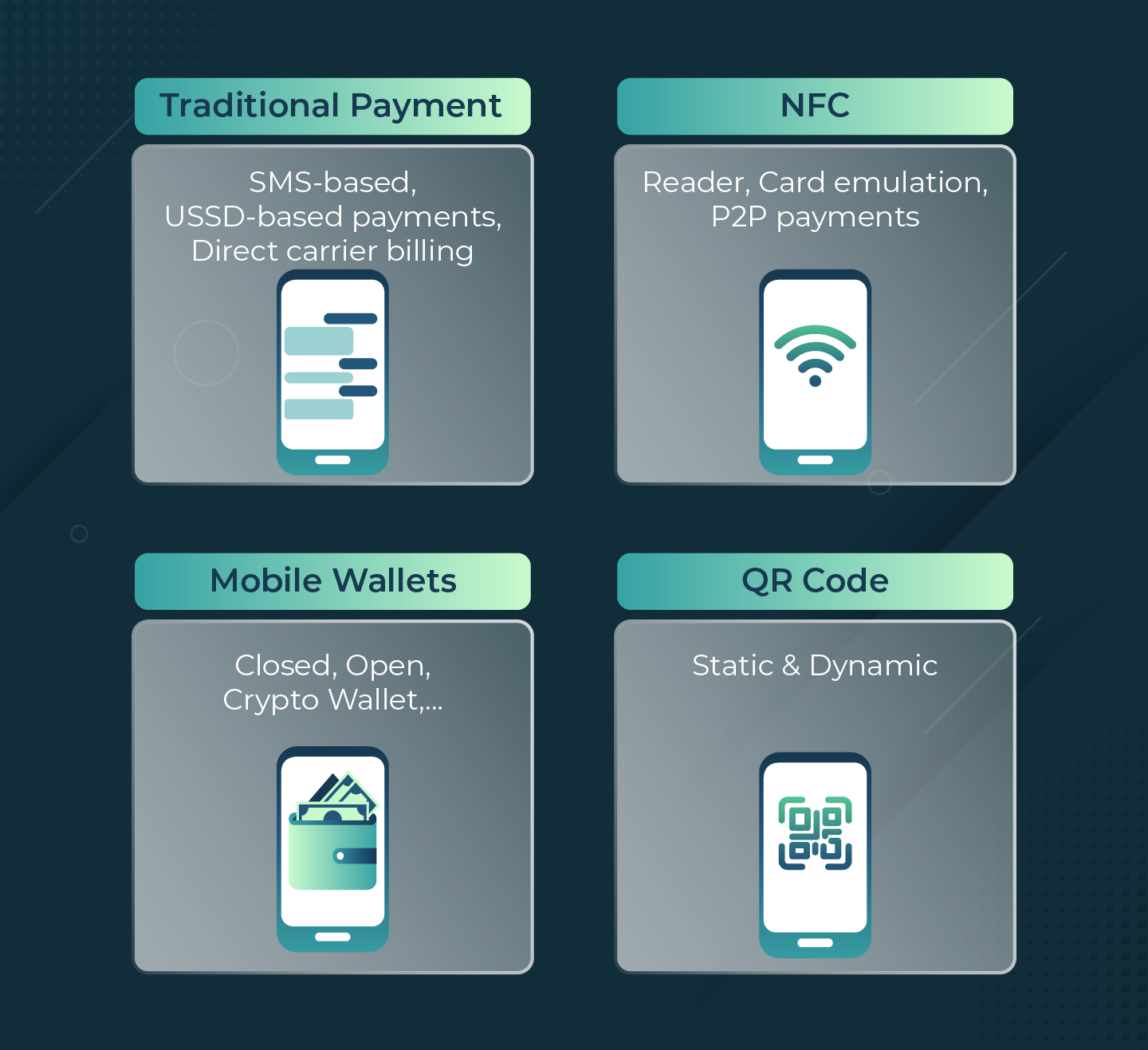

Types of mobile payments

Mobile payment refers to a financial transaction that is initiated through a mobile device such as a smartphone or tablet. Mobile payments offer several benefits, including convenience, speed, and security. They allow consumers to make payments quickly and easily, without the need to carry cash or physical cards in their wallets.

Today, with the availability of various mobile payment solutions, consumers can choose the one that best suits their needs. Based on the underlying technology or method used to process the payment, mobile payment types available are characterized as below:

1. Traditional Payments

Traditional mobile payment methods are now often used in regions with low smartphone penetration or limited internet connectivity but are gradually being replaced by more advanced mobile payment technologies.

Some examples of traditional mobile payment methods include:

SMS-based payments: This method allows users to send a text message to a short code number provided by the merchant to make a payment. The payment is then charged to the user’s mobile account.

USSD-based payments: USSD (Unstructured Supplementary Service Data) is a technology that allows users to access various services on their mobile phones by dialing a short code. With USSD-based payments, users dial a code provided by the merchant and follow the prompts to complete the transaction.

Direct carrier billing: This method enables users to charge a purchase directly to their mobile phone bill. Users typically need to enter their mobile phone number on the merchant’s website or app and then confirm the payment using an SMS or USSD code.

2. NFC Mobile Payments

NFC (Near Field Communication) enables data transmission over short distances, typically with payment terminals in physical stores. With this payment type, users can simply hold their mobile device near the payment terminal to complete a transaction in just seconds. This is considered the most favorable payment method across Europe.

There are three main modes of NFC mobile payments:

Card Emulation Mode: In this mode, the mobile device acts as a contactless payment card. User payment information is transmitted to the payment terminal when the device is tapped against it. This mode is commonly used for mobile payment services such as Apple Pay, Google Pay, and Samsung Pay.

Reader Mode: In this mode, the mobile device is used as a reader to access information stored on NFC tags or smart cards. This mode is often used for applications such as access control, ticketing, and loyalty programs.

Peer-to-Peer Mode: This mode allows two NFC-enabled devices to share data. It is used for activities on apps such as file sharing, contact sharing, and mobile payments between individuals on Android Beam and Samsung Beam.

3. Mobile Wallets

Mobile wallets are digital wallets that allow users to securely store their payment card information, such as debit or credit card details, on their mobile devices. They offer a wide range of payment options, including contactless payments in-store with NFC technology, online purchases, and in-app payments. Mobile wallets may also have additional features such as loyalty card storage, transaction history, and the ability to send and receive money from other users.

Mobile payment wallets are rapidly gaining popularity worldwide, particularly in the Asia-Pacific (APAC) region. According to The Asian Banker, the usage of mobile wallets is projected to increase from 42.1% (1.8 billion users) of the total APAC population in 2020 to 58.6% (2.6 billion users) by 2025, with a transaction value of around $7 trillion.

Currently, there are 5 available types of mobile wallets:

Closed Wallet: limited to transactions within a specific merchant or service provider, such as Starbucks gift cards or Walmart MoneyCards.

Semi-Closed Wallet: allows transactions within a network of merchants or service providers that have an agreement with the wallet provider, such as Paytm or MobiKwik in India.

Open Wallet: used for transactions at any merchant or service provider that accepts the wallet, such as PayPal, Google Wallet, and Apple Pay.

Crypto Wallet: used to store, manage, and use cryptocurrencies (Bitcoin, Ethereum or Litecoin). It can also be used to send or receive cryptocurrencies and track account balances.

IoT Wallet: Integrated with internet of things (IoT) devices, enabling transactions between machines and devices. It can be used for automated payments for services like utility bills, parking fees, or vending machine purchases. Examples include Samsung Pay, Fitbit Pay, and Amazon Go.

4. QR Code Payments

QR code payment method utilizes Quick Response (QR) codes to initiate transactions. QR codes are two-dimensional barcodes that can be scanned by a mobile device’s camera, allowing users to make payments quickly and easily.

Currently, there are two basic types of QR code payment methods:

Static QR code: Contains fixed information (Website URL, contact details, or product description) and cannot be changed once generated. This code is commonly used in marketing materials (Posters, business cards, or brochures) and can be scanned by any QR code reader app on smartphones.

Dynamic QR code: Contains information that can be updated or modified through a QR code management platform even after generated. It allows for usage tracking and analysis, such as the number or location of scans. This code can be used for a variety of purposes (inventory management, event ticketing, or payment transactions) but requires special QR code reader apps to handle the dynamic functionality.

QR code payments are increasingly popular in many countries, particularly in Asia, due to their convenience and ease of use. To utilize this payment, users first download a mobile payment app that supports this payment method, such as Momo or Zalo Pay, which are apps for mobile payment in Vietnam. After linking their bank account or credit card to the app, users can generate a QR code to initiate transactions.

Once the merchant displays a QR code, the user can simply scan it with their mobile device to complete the payment. The payment is then processed securely and the transaction is completed within seconds.

Ways to improve the mobile payment experience

As mobile commerce (m-commerce) continues to grow and dominate the market, businesses must focus on optimizing their mobile payment experience to remain competitive and increase profits. Here are some recommendations to consider when building your payment app:

1. Offer one-click payments

One-click payments are a convenient and efficient way to increase conversion rates and enhance the mobile payment experience for users. This feature allows users to go through multiple steps in payment transactions without the need to re-enter their payment information.

This feature is particularly useful for repeat purchases, such as in-app purchases or subscription renewals. Providers can combine one-click payments with other payment methods, such as QR codes or e-wallets to create an even more seamless and fast payment experience for users.

2. Optimize app performance

To ensure that mobile payment apps perform well under varying network conditions, the app development team can take the following steps:

Reduce network Calls: It involves minimizing the amount of data that a custom mobile app development company needs to transmit over the network in order to reduce latency, network traffic, and battery drain on apps. This can be achieved through strategies such as caching frequently accessed data on the device, prefetching data in advance, minimizing data usage, using push notifications to deliver data to the app, and using background fetching to update data in the app automatically.

Use Efficient Algorithms: Efficient algorithms enable fast and accurate processing of transactions, which can improve app performance. To achieve efficient algorithms, app developers need to carefully design and implement algorithms that are optimized for the specific requirements of the app. This involves understanding the data structures, algorithms, and techniques that are best suited for the app’s needs and optimizing the code to ensure that it runs efficiently on mobile devices.

Ensure Compatibility: Mobile payment apps should be compatible with various mobile devices, operating systems, and versions. Therefore, compatibility testing is necessary to ensure that the app works seamlessly on all supported platforms. This involves app testing on different devices with different screen sizes, resolutions, and hardware specifications, as well as different versions of operating systems such as iOS and Android.

Avoid Unnecessary Animations or Bulky Graphics: Excessive use of animations or graphics can slow down the app’s performance, especially on devices with limited resources. The app should instead be designed with a clean and simple interface that focuses on providing users with a fast and efficient payment experience.

3. Optimize Mobile Payment Security

Security is a top priority of any app for mobile payment, as users need to feel confident that their personal data and financial information are protected. To optimize a mobile payment app for security, it should be used encryption technology to protect data transmission and storage. This can prevent unauthorized access to steal sensitive customer information.

In addition to encryption, other ways to ensure app security include:

- Use encryption to protect sensitive customer information

- Implement two-factor authentication (2FA) to prevent fraud and unauthorized access

- Partner with reputable payment processors with a proven track record of secure transactions

- Use biometric identification, such as fingerprint or facial recognition, to enhance security

- Display security badges and logos prominently on the app to reassure users

- Comply with industry security standards, such as PCI-DSS, to ensure the app meets the highest security standards and provides a secure payment experience for users.

4. Use clear CTAs and feedback messages

Clear Calls to Action (CTAs) are crucial for an effective mobile payment experience as they guide users through the payment process, and reduce confusion and the risk of user drop-off or cart abandonment. Here are some tips for optimizing CTAs:

- Use concise and understandable language.

- Ensure that CTAs are easy to locate on screen.

- Clearly indicate the next step, for example, “Tap to Pay” or “Confirm Payment”.

- Use a contrasting color or bold text to make the CTA stand out.

- Test the CTAs to ensure that they are effective and easy to use.

Clear user feedback messages are also necessary to keep users informed of their transaction status. This includes some notification statuses such as “payment successful,” “payment failed,” and “transaction pending.”

5. Test and update regularly

Finally, it’s important to continuously test and update mobile payment apps to identify and fix issues before they become problems. By listening to user feedback and analytics, you can identify areas for improvement and add new features to enhance the app’s functionality.

Automated testing and monitoring tools can also be used to identify performance issues, security vulnerabilities, and user experience problems. These efforts help to ensure that the app is actively maintained and that users can rely on it for secure and efficient payments.

Final Thoughts

Creating a seamless mobile payment platform is an ongoing process that requires continuous effort and performance testing to eliminate any potential bottlenecks during the payment experience. By following the recommendations above, businesses can provide a great user experience and increase conversion rates.

If you are facing any obstacles in the process of building a payment app for your business, don’t hesitate to contact Terralogic for a free consultation. Our experts can help you overcome any challenges and create a mobile payment platform that meets your business needs and provides a seamless experience for your customers.

Keep reading about

LEAVE A COMMENT

We really appreciate your interest in our ideas. Feel free to share anything that comes to your mind.

Our 16 years of achievements includes:

-

10M+

lines of codes

-

2400+

projects completed

-

900+

satisfied clients

-

16+

countries served